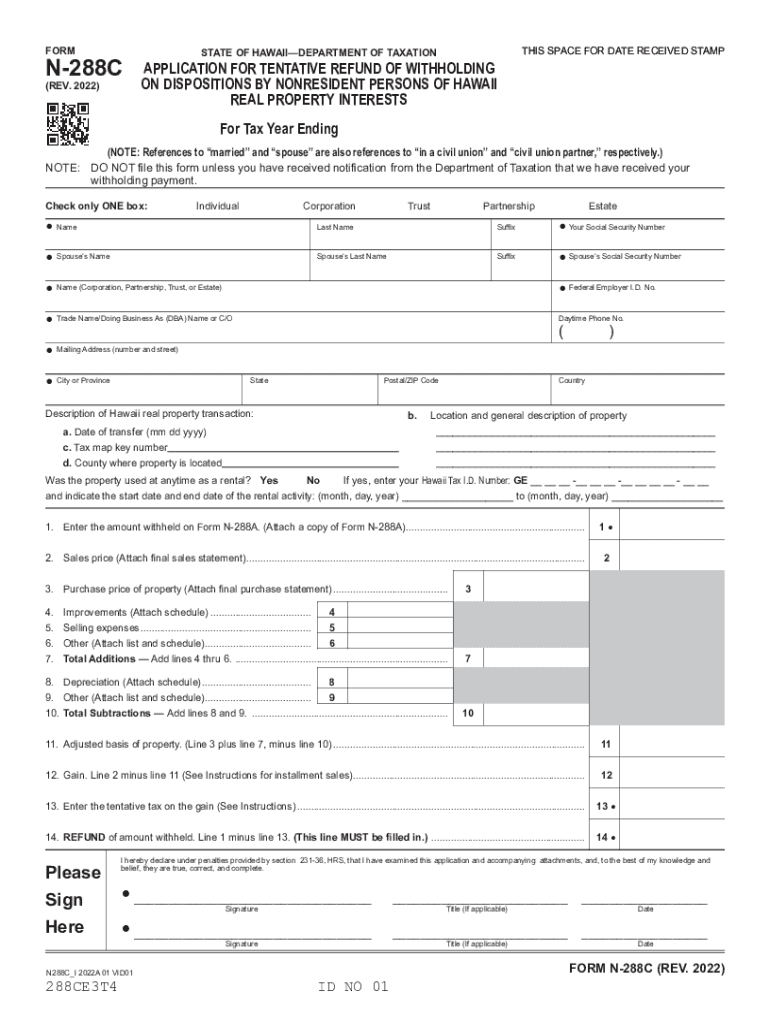

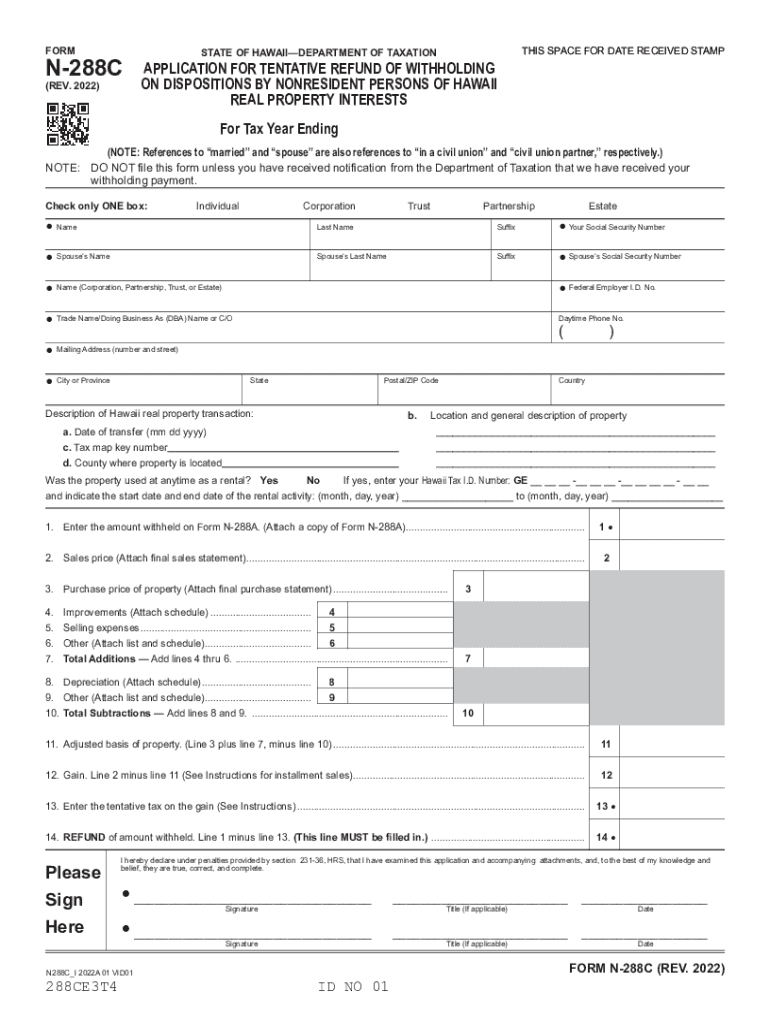

HI DoT N-288C 2022-2024 free printable template

Get, Create, Make and Sign

Editing hawaii form n 288a online

HI DoT N-288C Form Versions

How to fill out hawaii form n 288a

Who needs state Hawaii Form?

Video instructions and help with filling out and completing hawaii form n 288a

Instructions and Help about hawaii n 288c sample form

Hui aloha Mai Baku okay yeah oh lucky Land how little vodka we could make a video Asoka okay here we kill a home AHO EK Kay mom Male oh hello Niño oh c'mon male oh hello Niño ha ha ha ha ha ha ha Khan here come on all killer mother Lowell alone what are you doing what are you doing it's that simple what are you doing we use that question everyday like we probably ask somebody that question every day whether its what are you doing right now what did you do yesterday what did you do this morning what are you doing tonight like we asked that question all the time Marco little Hawaii and I'm still trying to help my family and my friends not to get poo Eva when somebody asked them the question here Cal Haney so hopefully you loco Kiev Akin kekekeke Okay or a who Eva ole a become a Navy cake I am you know your oily Casino here aha ha no beep ooh Eva when somebody asks you that especially a local Karaoke Father we have a small community class that's held once a week and in the class mom woke up Father a comma a Leona cuckold and one of the questions that we come earlier about is we asked everybody what what what did you do yesterday what did you do yesterday or what are you going to do tomorrow so um you have experience using it in class its always used but for some reason when it is used outside of class everybody gets Eva so don't get live please please please learn this question, and please know what somebody is asking you when you're asked this question because more often than not when you see your friends the first thing they asked you when you're going to chitchat is like oh how you and then what you did today or what you can do after this and because we always see each other at our meetings a lot of times the question we asked is Oh what you can do after the meeting or what you did this morning you know we just talk starting with each other like that right especially when we see each other every day, or you see your whole Papas you know what you're doing after class what you're doing after work you know so don't get POU evil when somebody sees you at the meeting, and they're like oh hey I owe my Buddy and maybe you guys is just sitting down and then your friend tells you oh hi ah okay Ella, and then you'll be like hey aha what Haney the working the work they are hard work and its just because you come to Eva that you go into that mind space but just know how Haney means what are you doing what did you do they're probably going to qualify it with alcohol, and you get Aka Aka Aka on EKG hola what did you do today what did you do this morning yeah oh honey Nan what did you do yesterday okay got it so well with me lets ask together ah, ah oh yeah haha ah baloney yeah Carranza Johanna and there is a calico Minolta cow Johanna Johanna Johanna below Merino my kola moment Abbey Hannah home mall New in Miami I'm okay here Kahuna Valley ah Letha Aloha yeah Colin ah okay so obviously hey uh cow Haney there's no time placed on that and there is a way for...

Fill hawaii form n 288a form : Try Risk Free

People Also Ask about hawaii form n 288a

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your hawaii form n 288a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.